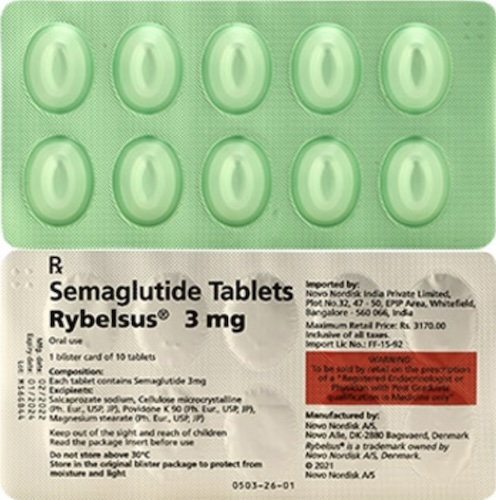

Rybelsus (Semaglutide)

- Active ingredient: Semaglutide

- Payment options: VISA, Mastercard, Amex, JCB, Bitcoin, Ethereum

- Delivery time: Registered Air Mail (14-21 days), EMS Trackable (5-9 days)

- Prices from $19

Buy Semaglutide Online

Discover How to Buy Semaglutide from Canada at Competitive Prices. Explore Canadian Versus Global Pricing, Ensuring Savings on Your Semaglutide Purchases.

Comparing Canadian Semaglutide Prices to Global Markets

- 🌎 Understanding Semaglutide’s Global Market Landscape

- 🇨🇦 Canada’s Unique Position in Semaglutide Pricing

- 💰 Comparing Costs: Canada Vs. Major Economies

- 🔍 Factors Influencing Price Variations Worldwide

- 📉 How Exchange Rates Impact Canadian Semaglutide Prices

- 🚀 Future Trends in the Global Semaglutide Market

🌎 Understanding Semaglutide’s Global Market Landscape

As semaglutide makes waves across global healthcare markets, its trajectory is nothing short of monumental. Initially lauded for its effectiveness in treating type 2 diabetes, semaglutide is now also recognized for its role in weight management—a transformation that has seen it hailed as a “magic elixir” in some circles. This meteoric rise has propelled semaglutide into the spotlight, with countries across the globe racing to accomodate it into their healthcare systems. Yet, as nations grapple with it’s pricing, the variances are striking, largely dictated by local healthcare policies, import duties, and the push-and-pull of patient demand versus supplier capabilities. Such disparities have painted a complex picture: while some markets enjoy relatively affordable prices, others are burdened with what might feel akin to “label sticker shock,” illustrating the significant price differentials in this global market landscape.

| **Country** | **Approximate Price (USD)** | **Notes** |

|————-|—————————-|———–|

| USA | $850 | Market driven, insurance-based. |

| UK | $600 | NHS negotiations influence prices. |

| Canada | $750 | Capped under government regulations. |

| India | $400 | Lower due to regional manufacturing. |

The intricacies of international semaglutide pricing reflect more than just raw economics. Factors like “cold chain” logistics—essential for maintaining the drug’s efficacy—impose additional costs, influencing how competitively a country can price its stocks. Furthermore, variations in GST or VAT can further skew prices from one nation to another. The dynamics of semaglutide within international pharmacies are, therefore, a delicate dance of healthcare objectives, financial constraints, and evolving market forces. As different regions strive to standardize costs amidst these challenges, the global market narrative continues to unfold—a tale marked by innovative highs and logistical trials, all in teh bid to deliver life-changing “scripts” to those who need them most.

🇨🇦 Canada’s Unique Position in Semaglutide Pricing

In recent years, Canada has positioned itself as a standout market for semaglutide pricing. This isn’t just about offering competitive costs but also about striking a balance between affordability and access. Canadian pharmaceutical regulations enable a unique stance where the cost of medications like semaglutide is often more stable when compared to other major economies. One reason for this stability is the intricate role played by the Pharmacy Benefit Managers (PBMs), which negotiate directly with manufacturers to keep prices in check, witout padding unnecessary costs.

Unlike the pharm party of unpredictable drug pricing seen in certain countries, Canada has a relatively transparent system. This transparency can sometimes translate into a slightly longer ‘fill day’ as stakeholders meticulously adhere to regulatory standards to acommodate public healthcare needs. The Canadian system opts for a different approach, emphasizing the importance of a fair price over quick but costly solutions. Consequently, buying semaglutide from Canada often becomes a strategic choice for international purchasers seeking consistency.

Another crucial aspect is Canada’s approach to generic drugs—generics play a significant role in keeping medication affordable. The Canadian goverment promotes their use whenever applicable, ensuring that effective treatments don’t come with a label sticker shock. This commitment extends to semaglutide, helping maintain its purchase price within a favorable range. Though the country does face challenges, they are often managed through robust health policies and expert pharmacy management.

Finally, Canada’s ability to adapt to global market shifts ensures its pharmaceutical landscape remains competitive. With constant surveillance on international trends, Canada is quick to adjust its strategies, avoiding the dramatic price hikes seen elsewhere. This adaptability is vital for the continuous supply of semaglutide at sustainable rates. As the world of pharmaceuticals evolves, so too does Canada’s approach, ensuring that patients aren’t left vulnerable to extreme market fluctuations.

💰 Comparing Costs: Canada Vs. Major Economies

Examining the costs of semaglutide across borders reveals some intriguing insights, ⭐ especially when juxtaposing Canada’s prices with those of global giants like the United States, Germany, and the UK. Canada, known for its more affordable medication pricing due to its robust price control mechanisms, presents a compelling case for international buyers. This affordability has led many to consider the notion of buy semaglutide from Canada as a cost-effective option, especially given the fluctuating pharma pricing in other nations.

In the United States, the price tag of semaglutide can be significantly higher, primarily driven by the nature of its healthcare system, where market forces play a crucial role, and the existence of multiple Pharmacy Benefit Managers (PBM). This often results in the ‘sticker shock’ moment for many U.S. consumers. In contrast, Europe’s approach varies—countries like Germany implement stringent price negotiations, resulting in more predictable pricing, though still higher than Canada’s.

Teh nuances in pricing strategies aren’t solely based on regulatory landscapes. Large economies often face complex negotiations between governments and pharmaceutical companies that lead to varied pricing outcomes. While Canada excels in such discussions to keep costs lower, countries with greater market power might not achieve similar deals due to their intricate healthcare logistics, leading them to ‘negotiate’ around different variables that affect consumer pricing. It’s a classic case of ‘count and pour’ in pharma pricing—balancing various influences to fill the best prescription price prescription.

As we delve into these disparities, consumers continue seeking channels to mitigate their expenses. Therefore, from a global perspective, Canada’s pricing strategy for semaglutide stands out, offering a beacon of affordability in the pharm land ocean. This drives a growing trend, making it increasingly attractive for international patients to consider their procurement options. 🚀

🔍 Factors Influencing Price Variations Worldwide

Price variations in the global semaglutide market are a fascinating blend of economic principles, regulatory landscapes, and healthcare dynamics. One of the pivotal factors arises from the complex interplay between each country’s healthcare policies and regulatory frameworks. Nations with robust healthcare infrastructure often engage in negotiated pricing to keep costs low, yet in some locales, such as the United States, prices are more influenced by the market, where supply, demand, and PBMs (Pharmacy Benefit Managers) play a significant role. These entities can impact costs dramatically through their ability to negotiate drug prices on behalf of insurance companies, sometimes leading to sticker shock for patients buying semaglutide without insurance backing.

Moreover, the manufacturing and distribution supply chains add another layer of complexity. Countries that produce semaglutide locally might offer more competitive pricing due to reduced shipping costs and tariffs. However, in regions where semaglutide is subject to import duties, prices can skyrocket. This is why some patients consider the option to buy semaglutide from Canada, where regulatory and geographical advantages offer a more favorable cost structure. Such pricing dynamics can be influenced by the intricate cold chain processes required to maintain the drug’s efficacy, ensuring it travels from manufacturer to patient safely and efficiently.

Lastly, the role of generics cannot be underestimated. As this market matures, the introduction of generics—once patents expire—can drive prices down significantly, yet not all countries have the same regulatory speed for approving these alternatives. The timeline from brand-name to generic availability varies, affecting global prices. Additionally, cultural differences in medication acceptance and the trust level in generics versus branded medications can shape price points. This wide variance in acceptance and the associated price shifts is what makes the semaglutide market so intriguing and variable globally.

📉 How Exchange Rates Impact Canadian Semaglutide Prices

Exchange rates play a critical role in determining the cost at wich consumers can buy semaglutide from Canada. When the Canadian dollar fluctuates against other major currencies, it immediately affects the cost of importing active pharmaceutical ingredients and impacts the pricing strategy for semaglutide within the country. A stronger Canadian dollar may make it more affordable for buyers from the U.S. or Europe to purchase the drug from Canadian sources, akin to a Pharm Party where participants exchange scripts at advantageous rates. Conversely, a weaker Canadian dollar could raise costs for Canadian consumers, leading to potential sticker shock when filling prescriptions at their local drive-thru pharmacy.

| Exchange Rate Impact | Outcome on Semaglutide Pricing |

|———————-|——————————–|

| Strong CAD | Lower prices for international buyers|

| Weak CAD | Higher prices for Canadian consumers |

Notably, exchange rate volatility is often beyond the control of pharmaceutical companies but dictates the financial maneuverability in global trading. The need to hedge against currency risks becomes apparent, ensuring stability in pricing irrespective of external economic conditions. Companies may strategically employ hedging tactics to maintain competitiveness and mitigate the risks tied to rate fluctuations. As much as consumers anticipate fair pricing without the unwelcome hangover effect of economic downturns, the intricacies of international finance dictate that sometimes the cost of semaglutide is as much about economics as it is about the drug itself. Such are the realities that pharmacies must navigate, with their white coats keeping a vigilant eye on financial charts just as much as on their formulary lists.

🚀 Future Trends in the Global Semaglutide Market

As we look ahead, the semaglutide market is poised to transform as innovation and demand propel it into new territories. With chronic diseases such as diabetes on the rise, semaglutide’s significance will become increasingly pronounced. Countries are exploring ways to make this ‘magic elixir’ more accessible and cost-effective, potentially leading to an upswing in generics. Yet, the ‘label sticker shock’ associated with the original trade name formulations still poses challenges for health systems worldwide. Compounding this, the ‘pill burden’ of patients may shift as research aims at more streamlined treatment regimens, which could redefine therapy landscapes.

Global collaborations and increased transparency in drug pricing negotiations could become the norm, potentially reducing disparities and leading to a more uniform cost structure. However, currency fluctuations and economic factors will continue to exert their influence, making the role of exchange rates in drug pricing more conspicuous. Moreover, as electronic prescriptions and AI-driven ‘count and pour’ technologies become commonplace, the efficiency in Pharm Land will increase, promising more reliable script management and distribution. As new players enter the market, competition will spark innovation, yet sustainability in production practices and equitable access remain vital considerations for the future.